COVID-19 and the resulting lockdown measures to limit outbreaks in Thailand have caused significant financial difficulties for many business operators, large and small. Whether a business is a creditor or debtor, there is a high likelihood they have faced or will face a default caused by the pandemic. This article identifies three legal options available when a party defaults—civil cases, bankruptcy actions, and business rehabilitation actions—and compares key elements associated with each option. For context, those three options are defined as follows:

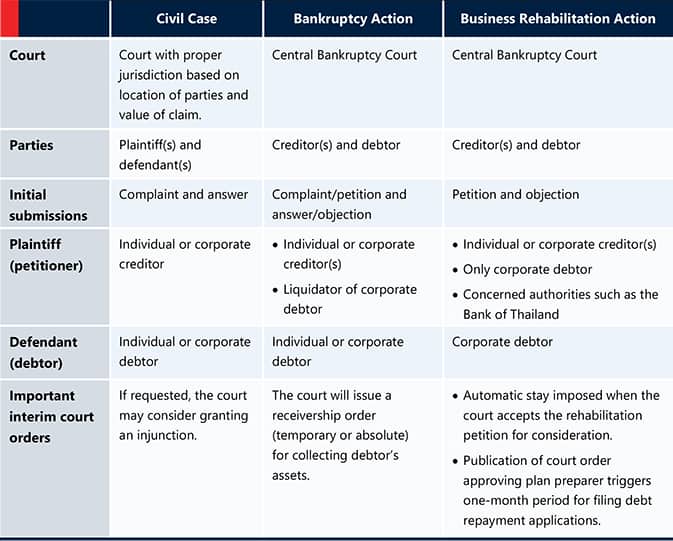

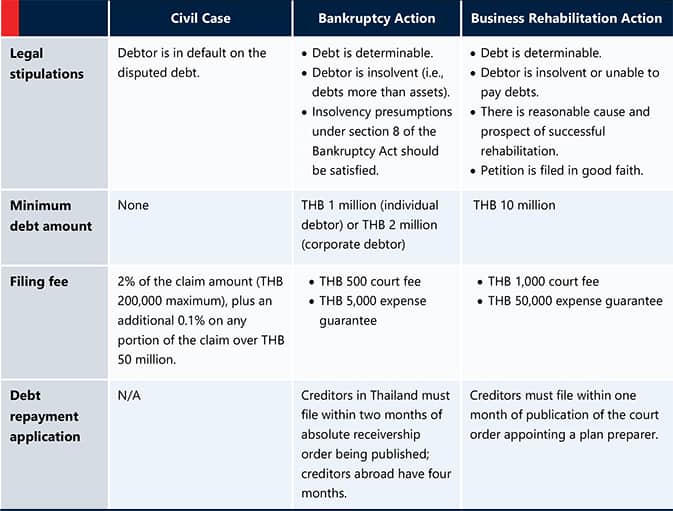

- Civil case. A legal proceeding in which a creditor files a civil lawsuit (or arbitration claim) against a debtor for debt collection. If a debtor fails to settle a debt in accordance with a judgment, the creditor can ask the court to enforce the judgment by seizure and sale of the debtor’s assets through public auction.

- Bankruptcy action. A legal proceeding under the Bankruptcy Act in which a government authority can collect a debtor’s assets, sell the assets by public auction, and distribute the net proceeds among creditors. In bankruptcy proceedings, the creditors will receive repayment in proportion to the size of the outstanding debts.

- Business rehabilitation action. A legal proceeding under the Bankruptcy Act aimed at helping a debtor recover from insolvency and continue its business. Debtors are given debt relief and a “new start” through business rehabilitation, while creditors are able to collect a higher percentage of outstanding debt under rehabilitation than they would under a bankruptcy action.

In short, a civil case is a claim in court for repayment of a specific debt, a bankruptcy action results in distribution of the debtor’s assets among the creditors, and a business rehabilitation action aims to enable the debtor to stay in business while repaying their debts to some degree.

A civil case may be appropriate when the debtor defaults on debt repayment and is indebted to only the creditor bringing the action. A bankruptcy action should be considered when the debtor’s liabilities are greater than its assets, and its business cannot continue. Business rehabilitation may be a good option when there is still a reasonable chance of reforming and rebuilding the debtor’s business. The three options also differ in a number of other ways, as laid out below.

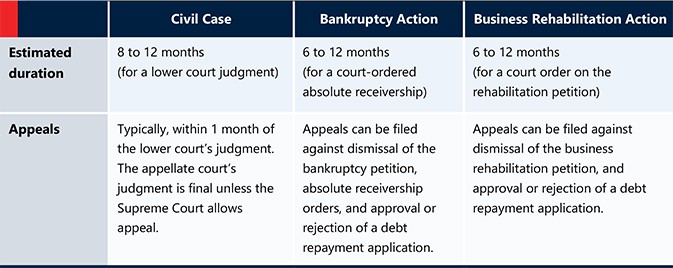

Legal Particulars

Requirements for Initiating Action

Proceedings

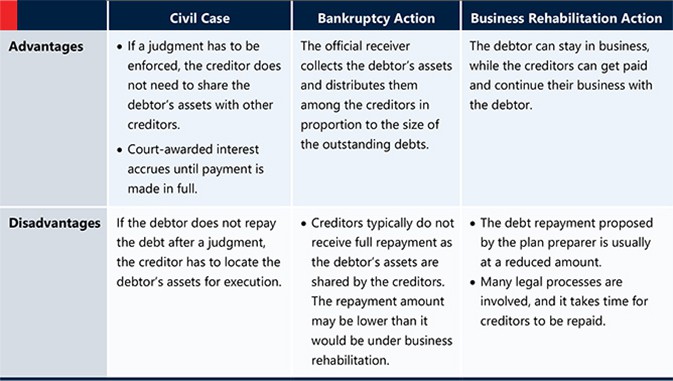

Advantages and Disadvantages

Conclusion

An essential step in pursuing any of these actions is retaining experienced local counsel who can offer tailored advice. Creditors should consider which of these three legal actions in Thailand best suits their needs and circumstances, and chart their course with the help of their legal advisor in Thailand. As noted above, a civil case might be the right option for a single creditor pursuing repayment, while bankruptcy actions and business rehabilitation are more far-reaching options that may be appropriate when there are serious underlying financial or structural issues affecting the debtor. With the aid of a specialist in debt recovery, bankruptcy, and business rehabilitation in Thailand, the creditor can consider the specific circumstances, lay out and execute a winning strategy, and resolve their debt recovery problems efficiently and cost-effectively.