Thailand’s Office of Insurance Commission (OIC) has released draft Notifications regarding Guidelines for Considering Qualifications and Suitability of Insurance Agents and Brokers to Manage Risks Related to Insurance Fraud for Life and Non-Life Insurance Companies for a public hearing period. The draft notifications set out criteria that life and non-life insurance companies should follow to assess the risk of brokers and agents committing insurance fraud.

Risk Rating

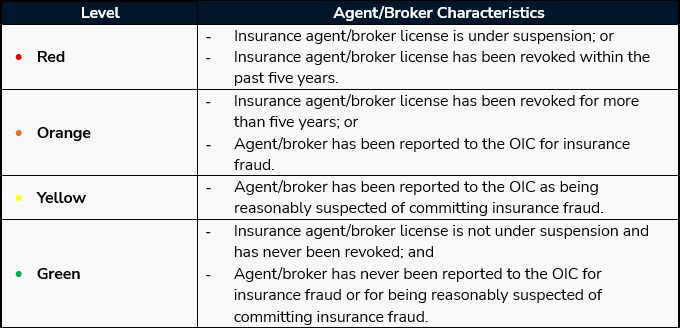

Under the OIC’s draft notifications, the risk of insurance agents and brokers committing insurance fraud is represented by four color-coded levels, according to the characteristics of the agent or broker. These levels are summarized in the table below.

Insurance companies can verify the qualifications and suitability of agents and brokers by accessing information on insurance fraud in the OIC’s database. This access must comply with the Personal Data Protection Act, requiring the consent of the agent or broker whose information is being accessed.

For more details on the OIC’s notification, or on any aspect of insurance regulations in Thailand, please contact Athistha (Nop) Chitranukroh at [email protected], Witchupong Chittchang at [email protected], Ajaree Trachukul at [email protected], Thammapas Chanpanich at [email protected], or Sireethorn Wijan at [email protected].