Vietnam’s Ministry of Finance has released a draft Decree on Tax Administration for E-Commerce and Digital Platforms (“Draft Decree”), introducing significant tax compliance obligations that could reshape how digital platforms, and individuals and business households conducting business through the platforms, manage their tax responsibilities. Aimed at strengthening tax enforcement, the Draft Decree requires e-commerce and digital platforms to actively track and withhold taxes from business households and individual sellers, and remit payments to tax authorities.

While it has not yet been promulgated, the Draft Decree is expected to take effect on April 1, 2025, leaving platforms with a limited window to prepare for compliance.

Who Is Affected by the New Tax Rules?

The Draft Decree significantly broadens the tax administration scope beyond traditional e-commerce platforms to cover a wide range of digital economy participants. Specifically, the Draft Decree places direct tax-related responsibilities on two major categories (collectively, “Regulated Operators”):

- E-commerce and digital platforms with payment functions (e.g., platforms that process buyer payments via e-wallets, bank transfers, cards, or cash-on-delivery); and

- Other digital-economy players that enable e-commerce transactions, including (i) intermediary service platforms connecting service providers with consumers, (ii) digital content platforms, (iii) online advertising providers, (iv) cloud computing and data storage providers, (v) social media platforms engaged in business activities (e.g., live-stream, in-app transactions), (vi) online education, gaming, and digital entertainment platforms generating revenue from digital transactions, (vii) Vietnam-based partners of foreign digital service providers facilitating local payments for overseas platforms, and (viii) intermediary payment service providers handling financial transactions for e-commerce activities.

Under the Draft Decree, Regulated Operators will be required to track, report, and enforce tax compliance for both resident and nonresident individuals and households conducting business through their platforms (“Sellers”).

What New Tax Obligations Do Platforms Face?

Onshore platforms

For the first time, Regulated Operators will bear direct tax enforcement responsibilities. This represents a significant shift from the current system, where Sellers bear the primary tax responsibility. Specifically, Regulated Operators must comply with the following key tax obligations:

- Ensure that every Seller provides a valid tax identification number (TIN) before being allowed to conduct transactions on the platform.

- Withhold VAT and personal income tax (PIT) from Sellers’ revenues before transferring proceeds, following the tax rates discussed in the section below.

- Issue e-commerce tax withholding certificates to Sellers annually and submit data to tax authorities. The tax withholding certificate must contain detailed transaction information, including the Sellers’ details, revenue, and withheld tax amounts, and the platform’s digital signature.

These requirements are designed to prevent tax evasion by anonymous Sellers operating on digital platforms. Notably, platforms that comply with their tax withholding obligations are exempt from additional transaction reporting requirements under Decree 91/2022/ND-CP. Nonetheless, it appears that Regulated Operators still need to report Seller information upon request by tax authorities.

The Draft Decree, however, leaves several aspects unclear, including:

- Liability of noncompliant Sellers: It remains uncertain whether Sellers who fail to provide TINs will be subject to higher withholding tax rates, restricted from conducting business, or potentially suspended from platform operations based on the severity of noncompliance.

- Liability of platforms: The Draft Decree does not specify whether Regulated Operators will face penalties for failing to collect TINs from Sellers. In addition, in a transaction involving multiple platforms, it would be difficult to identify which platform is directly liable for the tax withholding and payment.

- Implementation timeline: No clear guidance is provided regarding how long Regulated Operators will have to collect TINs from existing Sellers before enforcement begins.

Further clarification from regulators is expected to ensure a smooth transition and avoid disruptions for both platforms and Sellers.

Offshore platforms

Offshore platforms must comply with Vietnam’s foreign tax registration requirements under Circular 80/2021/TT-BTC, which requires, among other things, (i) electronic tax registration via the General Department of Taxation’s online portal and (ii) direct tax declaration and payment, or appointment of a Vietnam-based tax agent to handle tax obligations.

How Will Tax Withholding Be Calculated?

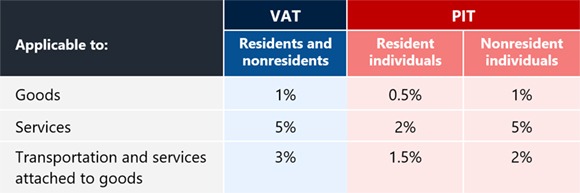

Under the Draft Decree, tax withholding must occur before Regulated Operators transfer payments from buyers to Sellers. Particularly, Regulated Operators are required to withhold VAT and PIT for each transaction, calculated as a fixed percentage of gross revenue based on the type of transaction.

The taxable revenue per transaction is defined as the total amount received from the buyer, collected by Regulated Operators on behalf of the Sellers.

The tax withholding rates are set out in the table below:

Notably, if a Regulated Operator cannot classify a transaction as goods or services, it must apply the highest withholding tax rates (5% for VAT and 5% for PIT). The withheld taxes must be declared and remitted monthly.

Outlook

With the decree set to take effect on April 1, 2025, the digital economy in Vietnam is on the brink of a major regulatory shift. While industry stakeholders are advocating for a postponement of the effective date, businesses should proactively prepare to mitigate regulatory risks and avoid operational disruptions. Successfully adapting to these changes will require Regulated Operators to focus on three key areas: tax compliance, data management, and Seller engagement.

To ensure a smooth transition, platforms may consider the following:

- Mapping out Seller categories (resident vs. nonresident) and evaluating potential tax liabilities based on the categories, transaction types, and revenue models (goods, services, or transportation).

- Developing education initiatives (FAQs, tutorials, chatbot assistance, etc.) to help Sellers understand their TIN registration, tax compliance, and data obligations.

- Implementing automated TIN collection and verification to ensure compliance before enabling Seller transactions.

- Implementing secure data storage systems to retain Seller transaction records in compliance with Vietnam’s tax administration laws.