On March 7, 2024, Laos moved to regulate the management of foreign-currency income from the exportation of goods and services. Effective March 29, 2024, Decision No. 333 (formally the Decision on Management of Income in Foreign Currency from Exportation of Goods and Services No. 333/BOL) from the Bank of Lao PDR (BOL) aims to incentivize the inflow of such foreign currency into Laos and its sale to licensed commercial banks.

Decision No. 333 sets minimum required proportions for importing income in foreign currency derived from the exportation of goods and services, as well as the timeframe for doing so. It also stipulates the requirements for selling such foreign currency to commercial banks in Laos and the minimum proportions that must be sold.

Importing Foreign-Currency Income

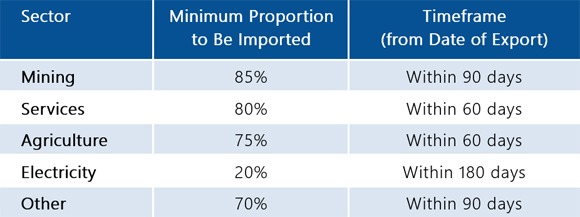

Exporters must receive payments from abroad via bank transfer into a dedicated bank account designated for import-export business activities within the timeline specified in the sale-purchase agreement, but not exceeding 180 days from the date of export. Each sector must import income in foreign currency into the Lao PDR according to the minimum proportion of currency to be imported, and it must be done within the required timeframes, as specified in the table below.

The ratios and timeframes are subject to change depending on the circumstances. If exporters cannot comply with the required ratio and timeline, exporters must provide relevant explanatory documents for the BOL’s consideration.

Selling Foreign-Currency Income

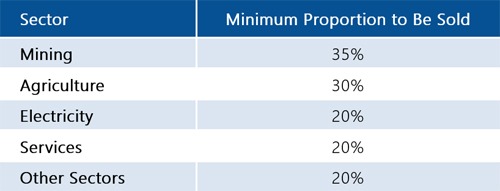

Exporters of goods and services must sell at least the minimum required proportion of their foreign-currency income (see table below) to a commercial bank in Laos. This foreign currency exchange must occur within three working days of receiving the foreign currency into the dedicated bank account in Laos. The selling rate will be determined by the prevailing rate of the commercial bank on the day of the transaction.

In conducting these transactions, commercial banks are required to carefully consider and manage their reserves and overall liquidity to ensure that they can meet public demand.

If an exporter does not sell at least the minimum required amount of foreign currency within three working days, the relevant commercial bank must proceed with the minimum required exchange and notify the exporter that they are doing so.

These requirements do not apply to re-exporters, such as importers of unprocessed raw materials for re-export to other countries, as determined by the Department of Foreign Currency Management (DFCM).

After selling the minimum required amount to a commercial bank, the remaining foreign-currency income must be used for foreign-currency exchange purposes, such as payments to parties in foreign countries, fulfilling obligations to the state, and so on.

Exporters can sell foreign currency to the BOL by notifying it of the need to sell the foreign currency to the DFCM in the BOL, after which they can sell the currency to the BOL through a commercial bank.

Registration

Decision No. 333 requires service exporters to register as importers and exporters to bring in income generated from exporting services. Although it doesn’t specify the types of service businesses that need to register, a March 2024 notice from the Ministry of Industry and Commerce offers examples of such businesses, including those in international transport, insurance, tourism and hotels, construction, and consulting.

Violations

First-time violations of Decision No. 333 that do not cause damage are subject to training on the importance of complying with Lao law or a warning. If the violation persists after the training or warning, the violator will face suspension of its ability to export goods and services.

For more information on Decision No. 333, or on any aspect of foreign currency management in Laos, please contact Tilleke & Gibbins at [email protected].