On December 7, 2017, the government issued Decree No. 141/2017/ND-CP stipulating new minimum wage requirements for employees working under labor contracts (Decree 141). Under the provisions of Decree 141, which will apply from January 1, 2018, the monthly minimum wage will be increased by VND 180,000 to 230,000 (USD 7.92 to 10.13), depending on the region.

Levels of Increase

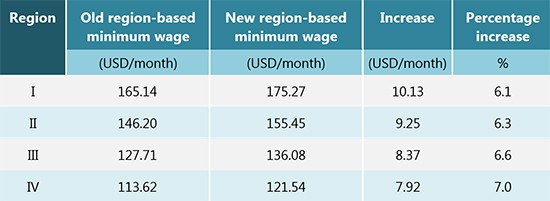

Decree 141 determines four minimum wage rates in Vietnam for four different regions (cumulatively covering the whole country). Each region is evaluated according to its socio-economic development, costs of living, and location. The specific level of minimum wage increase applied in each region is summarized in the table below:

Adjusted Regions

As mentioned above, the minimum wages vary across four geographical regions. The number of regions remains unchanged in the new decree, but there are slight adjustments to the list of cities/provinces which each region covers.

Under Decree 141, Region I spans the urban areas of Hanoi and Ho Chi Minh City. Region II covers the rural areas of Hanoi and Ho Chi Minh City, in addition to the urban localities of Can Tho City, Da Nang City, and Hai Phong City. Region III comprises the provincial cities of Bac Ninh Province, Bac Giang Province, Hai Duong Province, and Vinh Phuc Province, while Region IV covers the remaining localities. Some cities/provinces are moved up from Region II to Region I, from Region III to Region II, and from Region IV to Region III, while some others are moved down a level.

Reasons and Impacts

According to the Ministry of Labor, Invalids and Social Affairs, the level of minimum wage increase was calculated based on the necessary compensation for daily living expenses in 2017 to ensure that employees meet their minimum needs. Once Decree 141 comes into effect, the new minimum wages should help meet about 92-96% of the minimum living demands of employees and their families, depending on the region.

The above-mentioned adjustment plan was given taking into account the impacts of minimum wage increase on various matters such as jobs, unemployment, difficulties in manufacturing and trading, conditions of enterprises, minimum living requirements of employees and their dependents, etc. In particular, the adjustment plan was also affected by the new provisions which expand the range of employees who are subject to the statutory social insurance contribution (according to which employees with a labor contract of one month or more must participate in the social insurance scheme, as opposed to those with a contract of three months and more as presently), and the new salary will be used as the basis for payment of statutory insurance contributions.

As a result, the raise will meet basic living costs and certainly improve the living standards of employees and their families. However, on the other hand, the expenditures of enterprises will increase, as they must not only adjust the monthly salary of their workers, but must also increase their statutory insurance contributions.