On October 3, 2023, Thailand’s Board of Investment (BOI) issued a new regulation clarifying the eligibility criteria for investment promotion under the BOI category “5.10 Development of software, platforms for digital services, or digital content.”

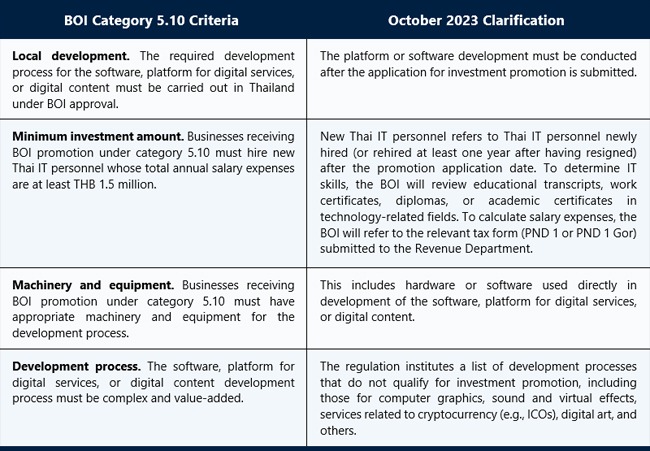

To be eligible for BOI promotion under the digital activity category, projects must meet criteria related to local development, minimum investment amount, machinery and equipment, and development processes. These criteria for category 5.10 activities, along with the latest clarifications from the BOI, are detailed in the table below.

Tax Incentives

The BOI also clarified the method for calculating corporate income tax (CIT) exemptions. The CIT cap amount is calculated on an annual basis from the prescribed expenses incurred after applying for BOI promotion and occurring during the year for which the CIT exemption is claimed. The allowances include 100% of expenses for salaries for newly hired Thai IT personnel, technology-related training, and obtaining quality standards (such as ISO 29110).

The revenue of projects that qualify for CIT exemption must be from sales or services directly related to software, platforms for digital services, or digital content developed as promoted by the BOI, including licensing fees, subscription fees, pay-per-use expenses, in-app purchase fees, usage fees, revenue sharing, advertising fees, and so on.

For more details on BOI promotion for digital activities, or on any aspect of investment promotion in Thailand, please contact Athistha (Nop) Chitranukroh at [email protected] or +66 2056 5600, Napassorn Lertussavavivat at [email protected] or +66 2056 5662, or Thammapas Chanpanich at [email protected] or +66 2056 5561.