In 2019, Thailand introduced an online system for payment of stamp duty (e-Stamp Duty) and a requirement for e-Stamp Duty to be paid on the following five instruments when executed electronically (e-Instruments):

- hire of work service instrument;

- loan instrument or bank overdraft instrument;

- powers of attorney (POA);

- proxy letters for voting at company meetings; and

- guarantee instrument.

However, given the strict financial penalties on those who fail to pay stamp duty, the government implemented a grace period until December 31, 2020, to allow people to become familiar with the e-Stamp Duty system before the requirement is strictly enforced. During the grace period, taxpayers could pay stamp duty for the five e-Instruments at an area revenue office, rather than via the e-Stamp Duty system, and could also pay stamp duty for traditional paper versions of those five instruments through the e-Stamp Duty system.

On January 19, 2021, the Revenue Department issued Notifications of the Director-General of Revenue Re: Stamp Duty (Nos. 61 and 62) B.E. 2564 (2021) further extending that grace period until December 31, 2021.

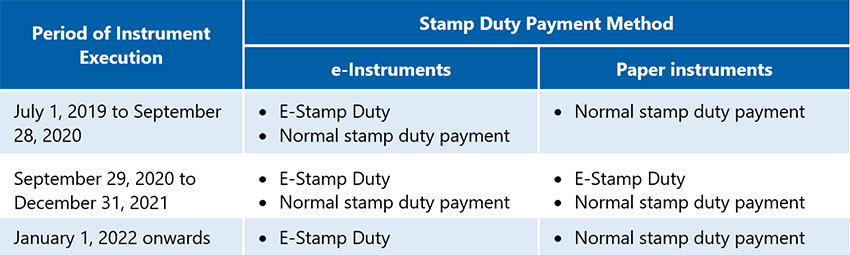

The following table summarizes the revised methods of stamp duty payments available for the five instrument categories mentioned above under the new notifications.

The e-Stamp Duty system allows taxpayers to pay stamp duty online by filing the prescribed form (Form Or.Sor.9) through (i) the website of the Revenue Department (www.rd.go.th), or (ii) the Application Programming Interface (API) of the Revenue Department before or within 15 days from the date of instrument execution.

Taxpayers can currently file a request to pay for e-Stamp Duty no earlier than 30 days before the date of instrument execution.

Taxpayers should note that the e-Stamp Duty system does not currently support late payment. Therefore, late filing and stamp duty payments will have to be made at an area revenue office.

For more information about stamp duty, or any aspect of tax law in Thailand, please contact Varapa Aurat at [email protected].