In November 2024, Thai Prime Minister Paethongtarn Shinawatra unveiled ambitious plans to enhance tax incentives for foreign film productions during a networking reception in Los Angeles, coinciding with her visit to the APEC Economic Leaders’ Meeting in Lima, Peru. This event, attended by Motion Picture Association executives and leaders from top US film companies, marked a significant commitment to boosting foreign investment in Thailand’s film industry.

Thailand’s Department of Tourism (DOT) prioritized the initiative by updating the Announcement on Guidelines, Procedures, and Conditions for Applying for Benefits Under the Incentive Measures for Foreign Film Production in Thailand in December 2024 to further position Thailand as a destination for large-scale international film and television productions.

Key Amendments to Film Incentives under the 2024 Announcement

The 2024 announcement introduced major changes, including (1) removal of the rebate cap, previously set at THB 150 million (approx. USD 4.5 million) per project, enabling rebates based on total qualified spending, and (2) an increase in cash rebate rates. The maximum allowable cash rebate rate was increased to 30 percent from the previous cap of 20 percent. The base rate of 15 percent remains unchanged.

The primary incentive available under the 2024 announcement is a 15 percent cash rebate on qualified spending in Thailand of at least THB 50 million (approx. USD 1.5 million).

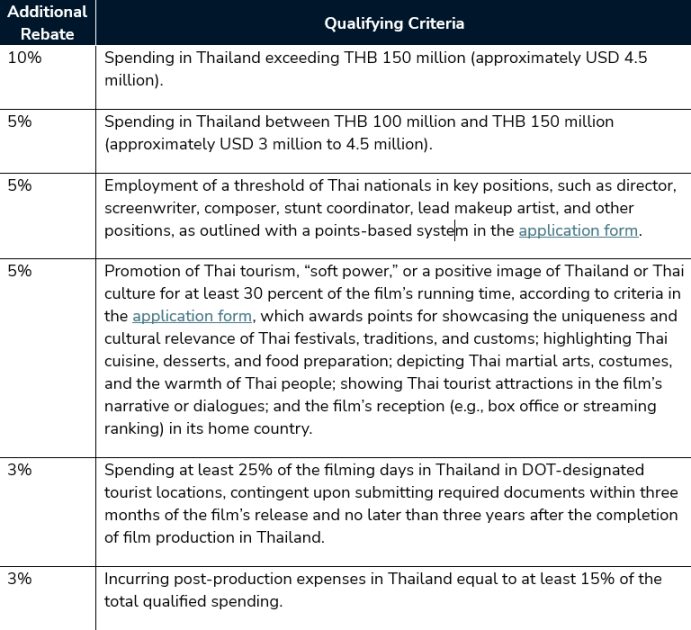

On top of this primary incentive, additional incentives are available; however, the total possible cash rebate is capped at 30 percent, and the additional incentives can only amount to an added 15 percent. Also, the total rebate (including both primary and additional incentives) for films with a budget of less than THB 100 million (approx. USD 3 million) is capped at 25%.

To obtain a higher rebate rate, productions may apply for the following additional incentives:

Compliance Requirements

Foreign production companies seeking to benefit from Thailand’s enhanced film incentives must navigate a structured application and compliance process. The 2024 announcement establishes different processing periods for applications based on spending thresholds. Noncompliance with these procedural requirements could jeopardize eligibility for the rebates, regardless of the actual amount spent in the country.

One of the key criteria for receiving the incentives is that the filming must not cause or result in environmental damage or harm to natural resources; otherwise, the approved incentives will be revoked.

The timing of this policy is noteworthy, given the recent decision regarding an environmental dispute in which Thailand’s Ministry of Natural Resources and Environment sued a major production company for over THB 100 million (approx. USD 3 million), alleging ecological damage caused during filming. The lawsuit claimed that alterations to a bay landscape and failure to comply with legal requirements and agreements established with the authorities resulted in extensive environmental harm, including deforestation and coral reef destruction. After 20 years of legal proceedings, the Thai Supreme Court ruled in 2022 that the production company must pay THB 10 million (approx. USD 300,000), or 10% of the original claim. This case underscores the risk of noncompliance with legal requirements, which can result in negative publicity, financial liability, and the loss of eligibility for incentives.

Tax Implications and Documentation Requirements

The rebate mechanism interacts with several Thai tax considerations that foreign production companies should carefully evaluate. The 2024 announcement specifies that the rebate itself is subject to 1% withholding tax under the Thai Revenue Code. Additionally, service and rental expenses paid to Thai providers typically attract withholding tax rates of 3% and 5%, respectively, while most goods and services in Thailand are subject to 7% VAT (value-added tax), significantly impacting overall production budgeting. The rebate application process also requires comprehensive financial documentation as specified in the requisition form, with all expenses requiring proper verification according to Thai Revenue Department standards.

Understanding which preproduction, production, and postproduction expenses qualify (particularly the requirement that physical production expenses in Thailand must be at least 50% of total qualified spending) requires careful planning. Professional tax and legal advice can help companies optimize their structure to maximize eligible expenses while ensuring regulatory compliance.

Final Remarks

Thailand’s revised film incentives under the DOT’s 2024 announcement provide lucrative opportunities for foreign film and television productions. By enhancing financial incentives, Thailand aims to attract more international projects, thereby stimulating economic growth and promoting cultural exchange. As the global film industry continues to evolve, Thailand’s proactive approach positions it as a competitive and attractive destination for filmmakers worldwide. Productions planning to capitalize on these incentives are advised to consult local experts to navigate the regulatory landscape effectively.